RYI (RYI)·Q4 2025 Earnings Summary

Ryerson Misses Q4 as LIFO Surge Crushes Margins; Guides to Recovery in Q1

February 6, 2026 · by Fintool AI Agent

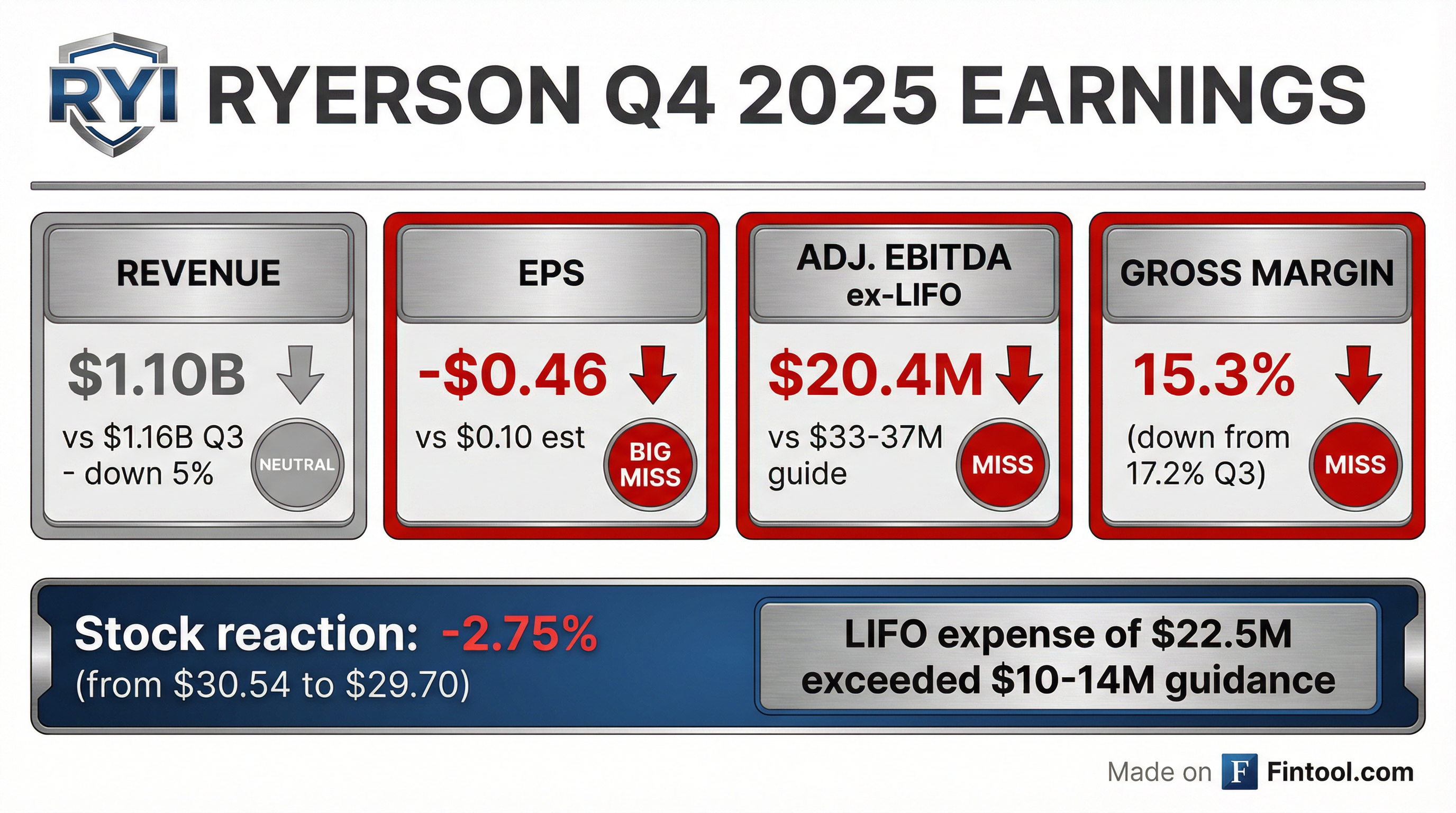

Ryerson Holding Corporation (NYSE: RYI) reported a significant Q4 2025 earnings miss, with normalized EPS of -$0.46 falling well short of the $0.10 consensus estimate . The metals distributor's quarter was derailed by an unexpected surge in LIFO inventory expense that crushed gross margins, though management pointed to strong early-2026 bookings and guided to a meaningful Q1 recovery. The stock fell 2.75% on the news.

Did Ryerson Beat Earnings?

No — a significant miss on EPS and Adjusted EBITDA.

*Values retrieved from S&P Global

The culprit was clear: LIFO inventory expense of $22.5M exceeded guidance by 60-125% . Material input costs rose faster than Ryerson anticipated during the quarter, while resale prices remained flat due to normal contract pricing resets and soft industrial demand on spot business .

Excluding LIFO, gross margin decreased by only 100 basis points QoQ to 17.3% — still a compression, but far less severe than the headline 190 bps drop .

How Did the Stock React?

RYI shares fell 2.75% from $30.54 to $29.70 following the earnings release . In after-hours trading, shares dipped further to $29.45.

The stock had rallied ~50% from its 52-week low of $19.02 heading into this report, lifted by the Olympic Steel merger announcement in October. Despite the Q4 miss, shares remain well above year-ago levels.

What Caused the Margin Compression?

Three factors combined to squeeze Ryerson's profitability:

-

Material cost surge: Input costs rose faster than anticipated during Q4, creating a COGS headwind before prices could be passed through

-

Flat selling prices: Average selling prices were essentially unchanged (+0.1% QoQ) as normal contract pricing resets and soft spot demand prevented markup expansion

-

Volume decline: Tons shipped fell 4.9% sequentially due to normal seasonality and soft industrial demand

Operating expenses were largely in-line at $206.8M, though this included $7.8M in advisory fees related to the Olympic Steel merger .

What Did Management Guide?

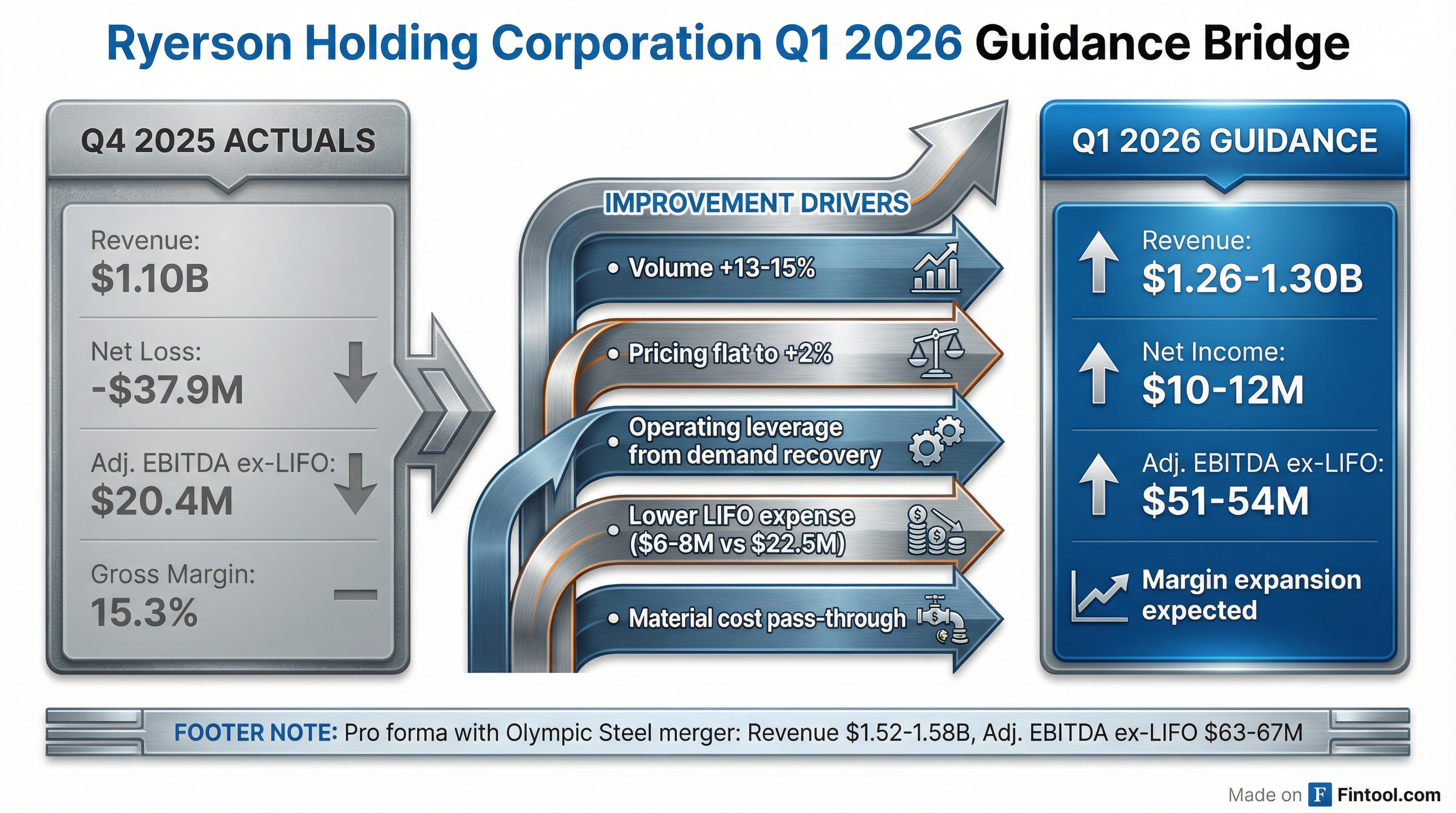

Q1 2026 guidance represents a significant improvement — Ryerson expects to return to profitability:

Key driver: Bookings in early 2026 have been "strong relative to years past" according to management, and Q4 inventory cost increases should flow through to Q1 selling prices .

What About the Olympic Steel Merger?

The transformational merger remains on track:

- Shareholder votes: February 12, 2026 for both Ryerson and Olympic

- Expected closing: Q1 2026

- Shareholder litigation: 14 demand letters and 2 complaints filed, but Ryerson/Olympic believe all allegations are "without merit"

Pro Forma Q1 2026 (if merger closes mid-February):

- Revenue: $1.52-1.58B

- Adj. EBITDA ex-LIFO: $63-67M

The combined company would create a larger, more diversified metals service center platform.

What Changed From Last Quarter?

Positive development: Despite the earnings miss, Ryerson generated $112.7M in operating cash flow during Q4, using the seasonal working capital release to reduce debt and bring leverage down toward its 0.5-2x target range .

Historical Performance Context

Ryerson has struggled with profitability amid soft industrial demand:

*Values retrieved from S&P Global

The company has now missed EPS estimates in 4 of the last 5 quarters, though 3 of those misses occurred amid challenging industrial demand conditions.

Key Risks and Concerns

- Merger execution risk: Shareholder lawsuits and integration complexity with Olympic Steel

- Industrial demand: Continued soft conditions in manufacturing end markets

- LIFO volatility: Material cost fluctuations create earnings unpredictability

- Leverage: At 3.1x, still above the 0.5-2x target range, though improving

Forward Catalysts

- Feb 12, 2026: Shareholder vote on Olympic Steel merger

- Q1 2026: Expected merger closing and first combined results

- Margin recovery: Q1 should see pricing catch up to Q4 cost increases

- Deleveraging: Continued debt paydown toward target leverage

This analysis is based on Ryerson's 8-K filing dated February 5, 2026. For the full earnings transcript, see RYI Documents. For company research, see RYI Overview.